Warehouse space that fulfils certain needs sells quickly

Rainer Hinno, Member of Favorte’s Management Board, summarises the trends for the new year and gives an overview of the current situation in the warehouse segment. Enjoy your reading!

1. What lies ahead for warehouse space developers and tenants in 2024?

The number of companies that are not ready to conclude a deal when the project is still on paper has increased, the vast majority of contracts are signed only after the start of construction. This situation requires a high-risk tolerance, and only stable and strong companies that are focused on the long-term market and not subject to short-term fluctuations can afford development.

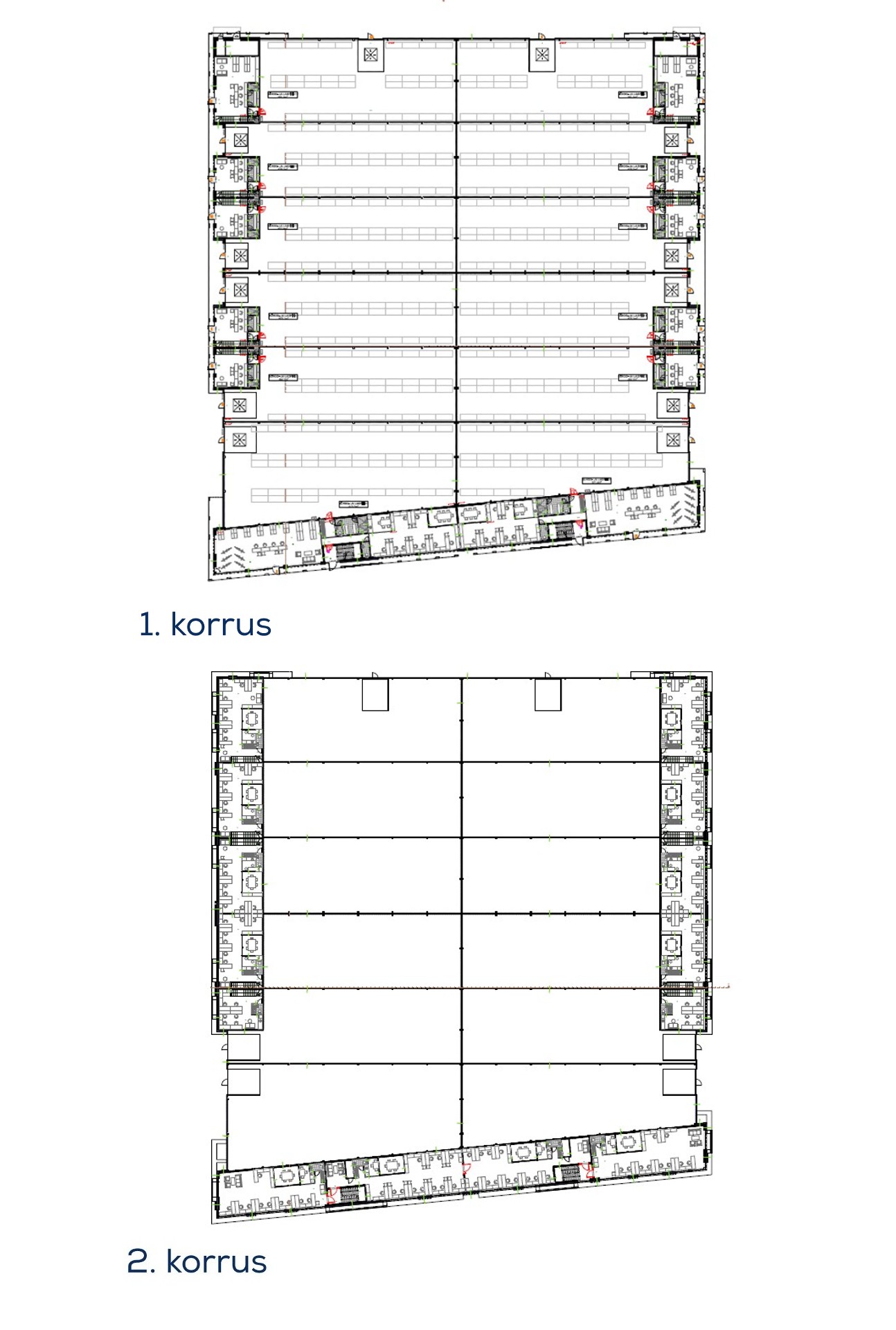

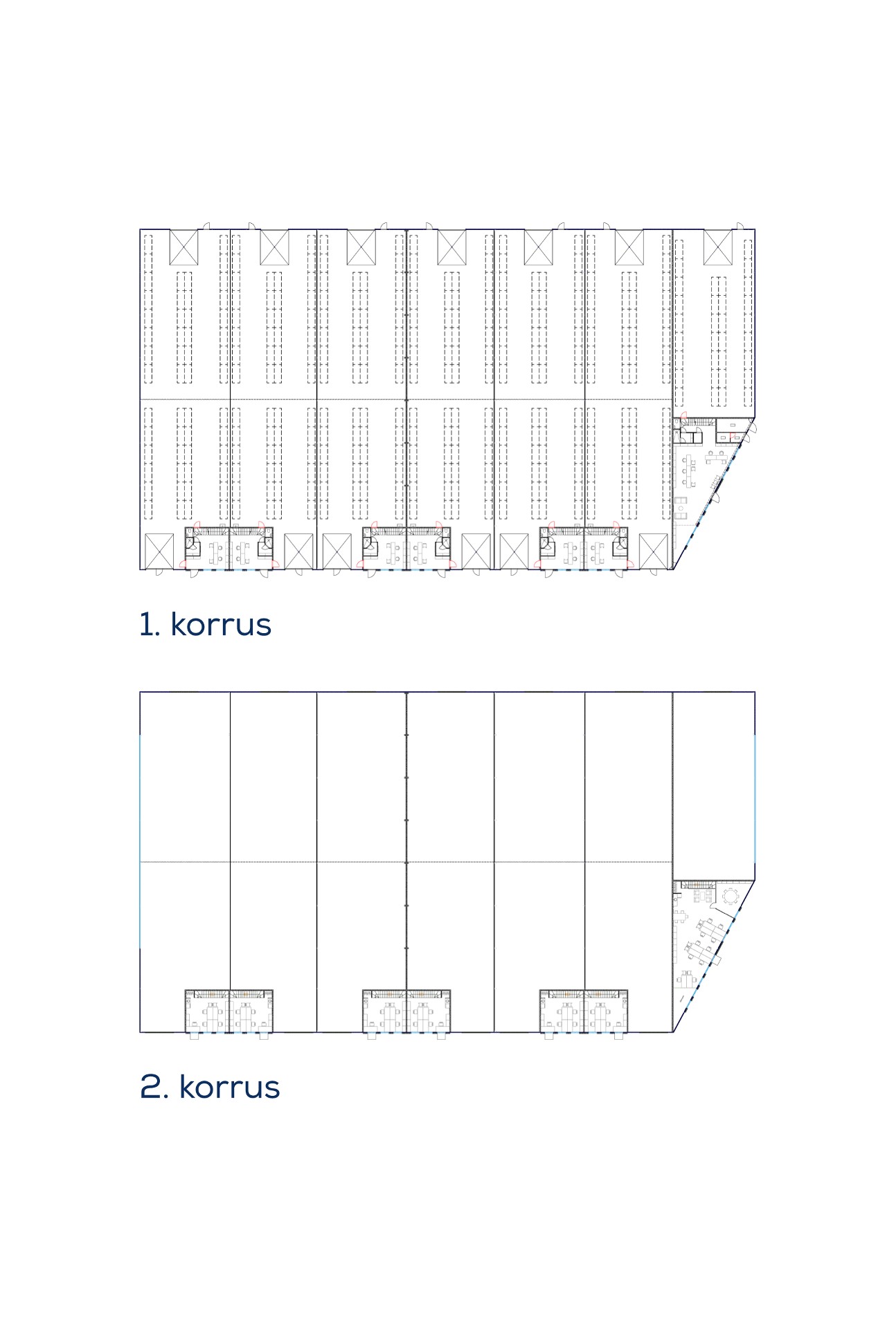

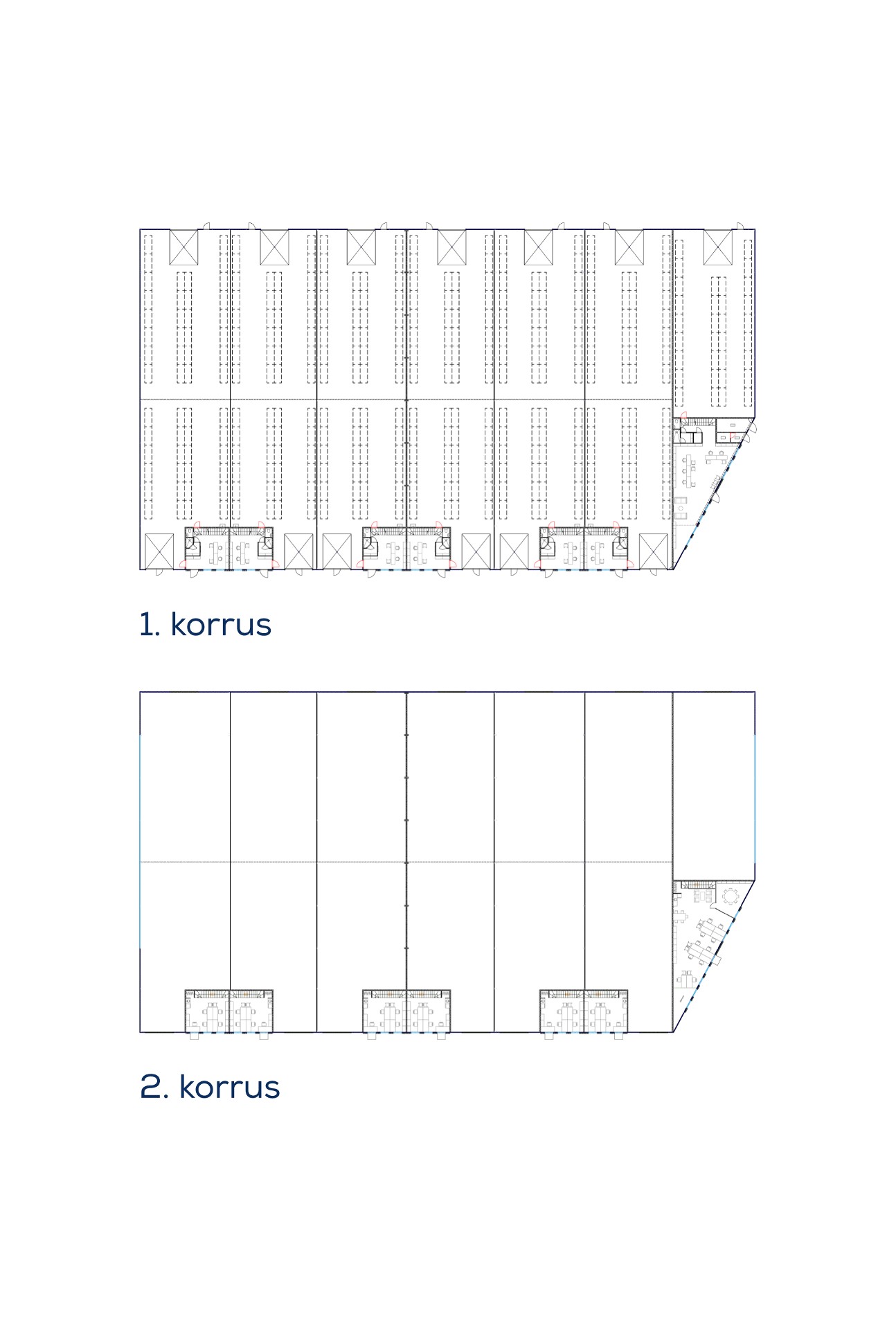

Some developers have postponed the start of new projects indefinitely, so a client looking for new and modern commercial premises should realize that there will be less and less commercial space on the market in the near future. Despite the fact that real estate websites are full of offers, there are not many warehouse projects under construction and it is more about probing the market. This has also led to longer waiting times to get keys to warehouses. At Favorte, we continue to launch new stock office type projects at the planned scale, with 22,298 m2 of Favorte Stock commercial space to be built in 2024. As the prices of raw materials, interests and labour costs have increased significantly compared to a few years ago, there is no reason to expect rental prices to decrease.

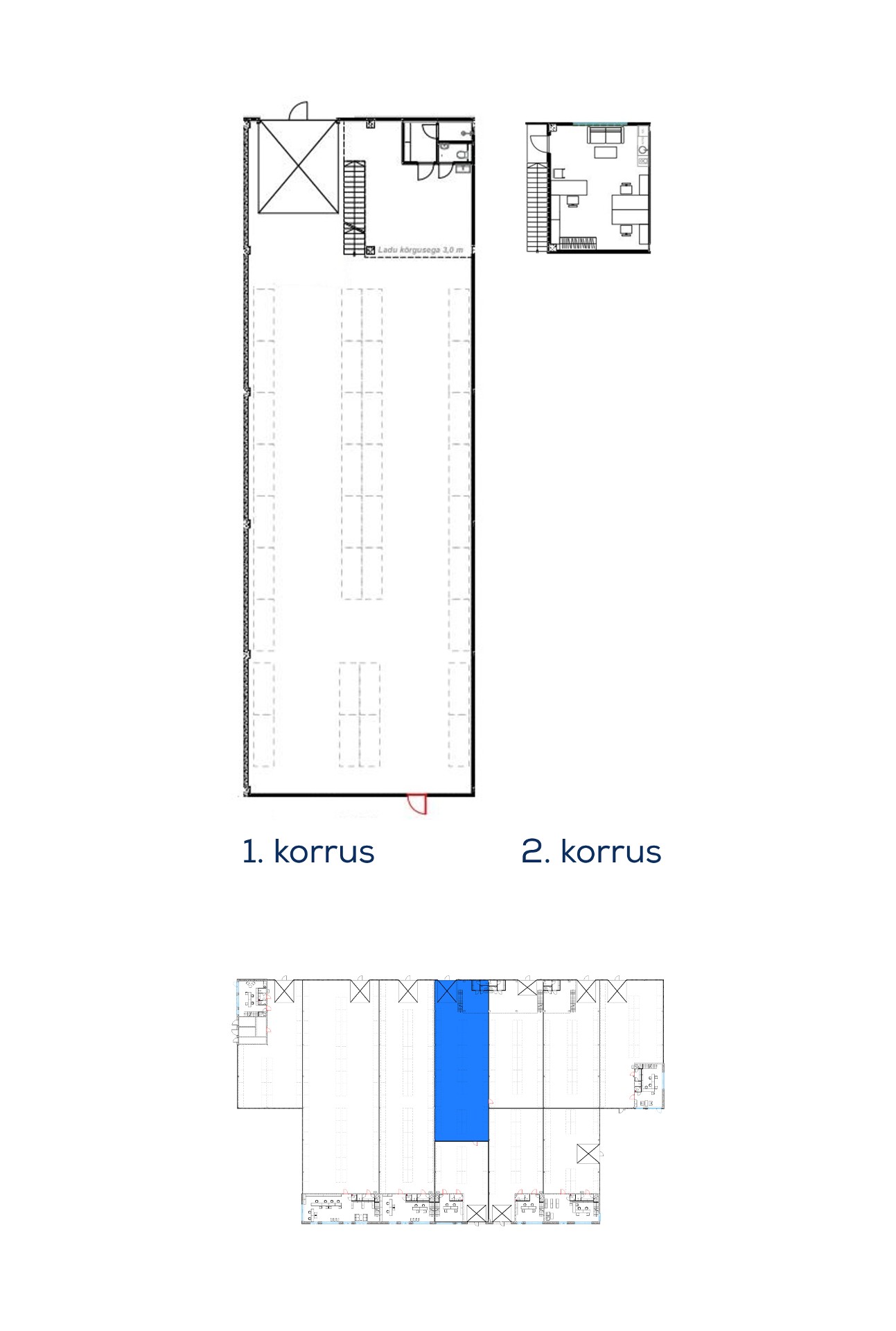

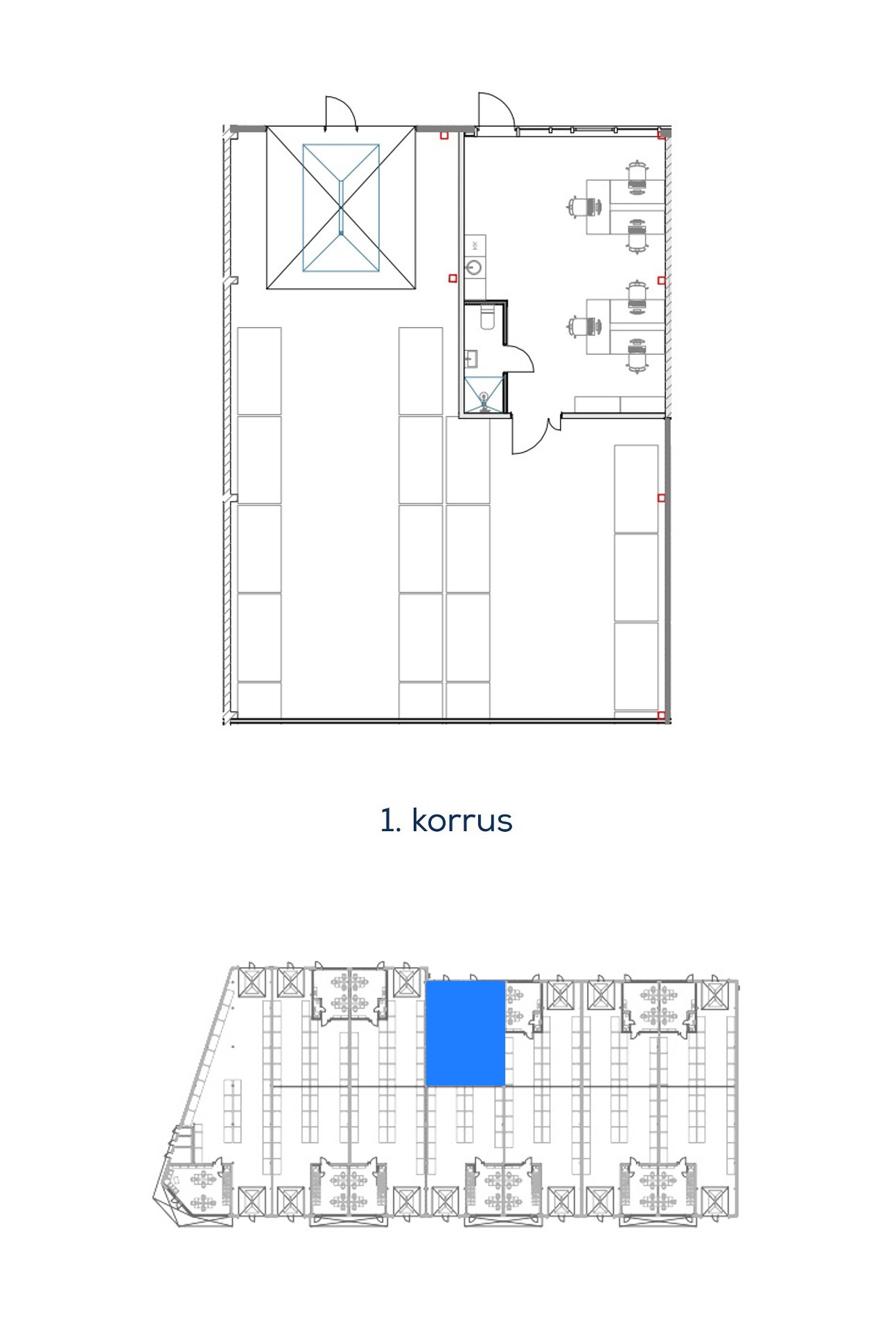

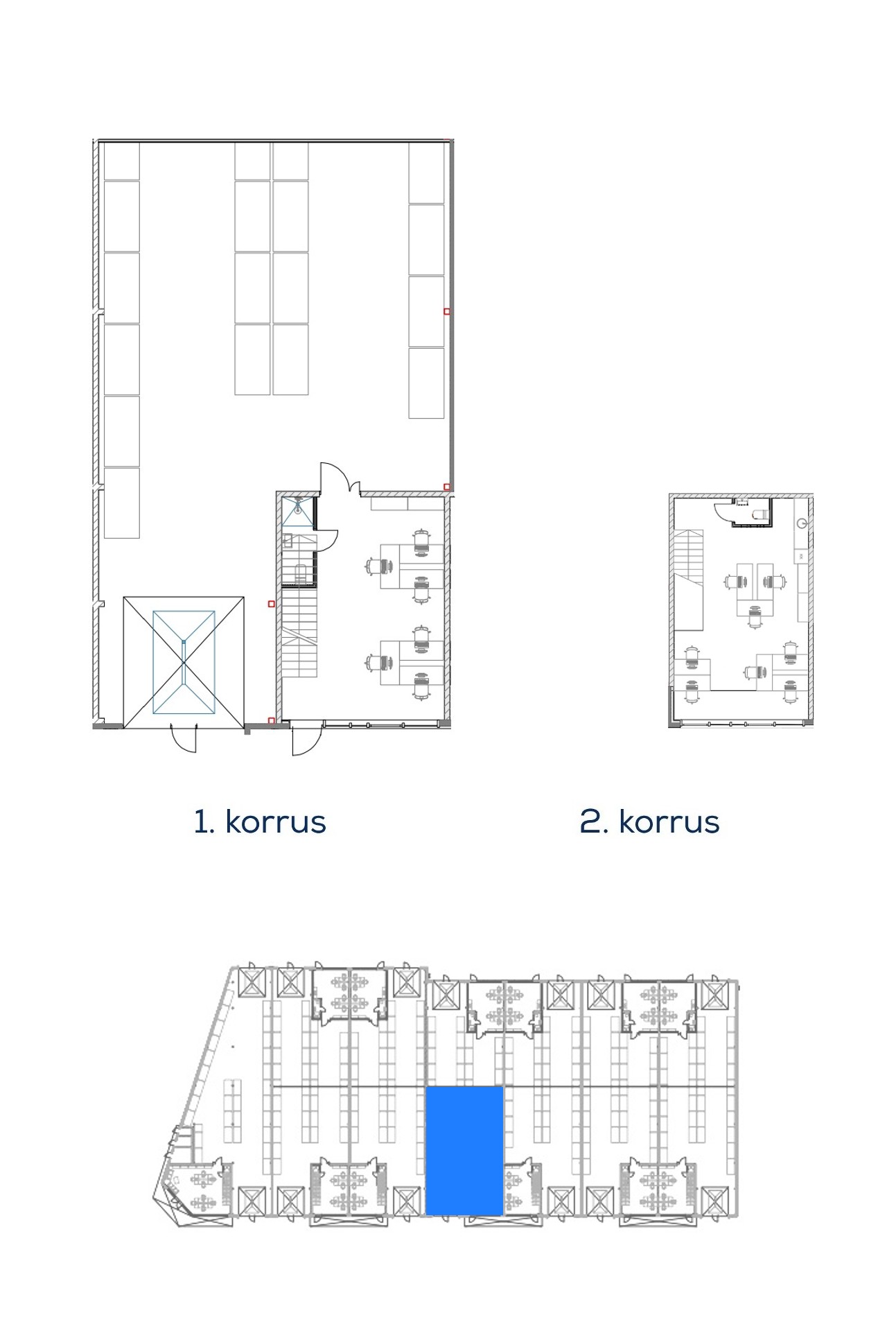

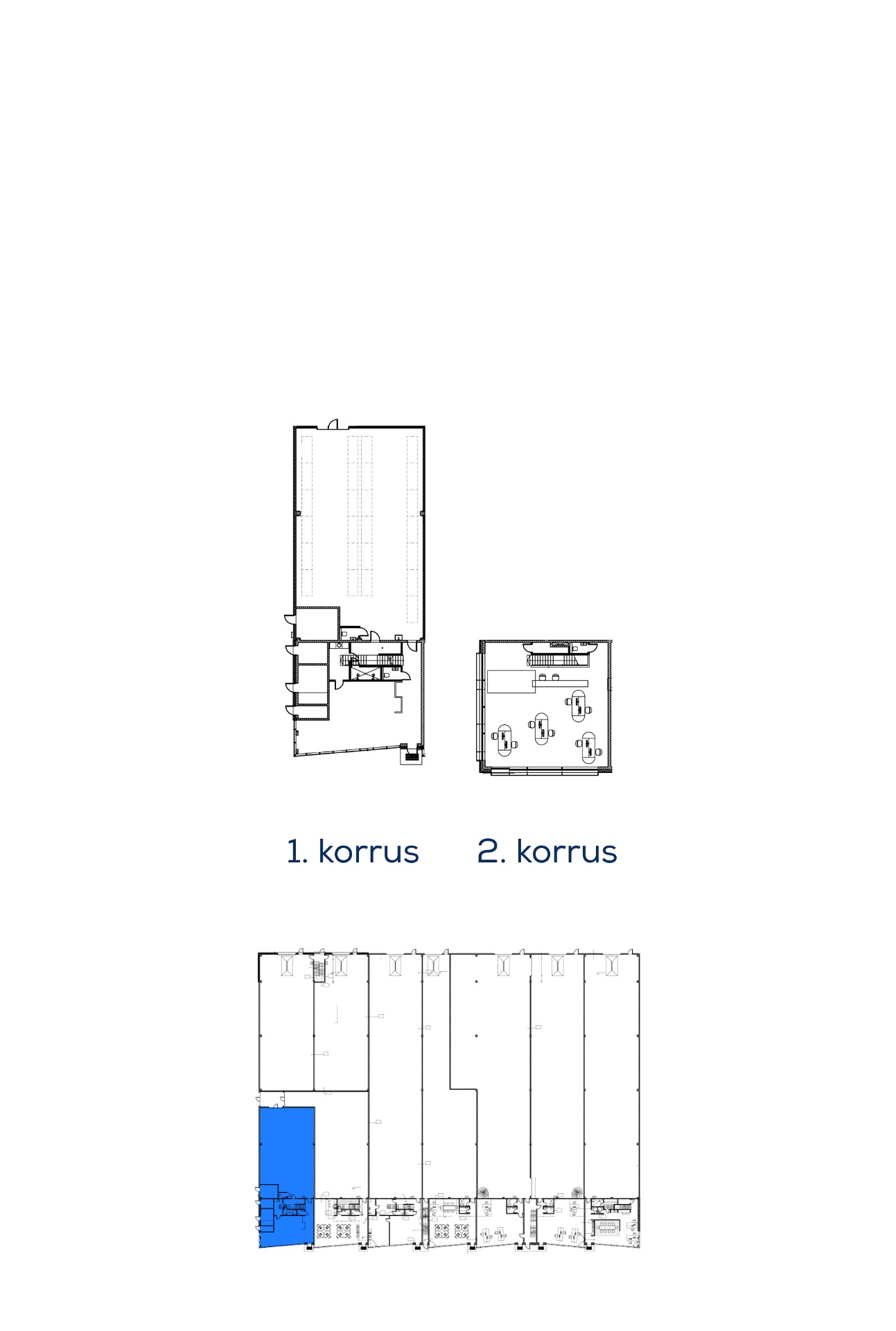

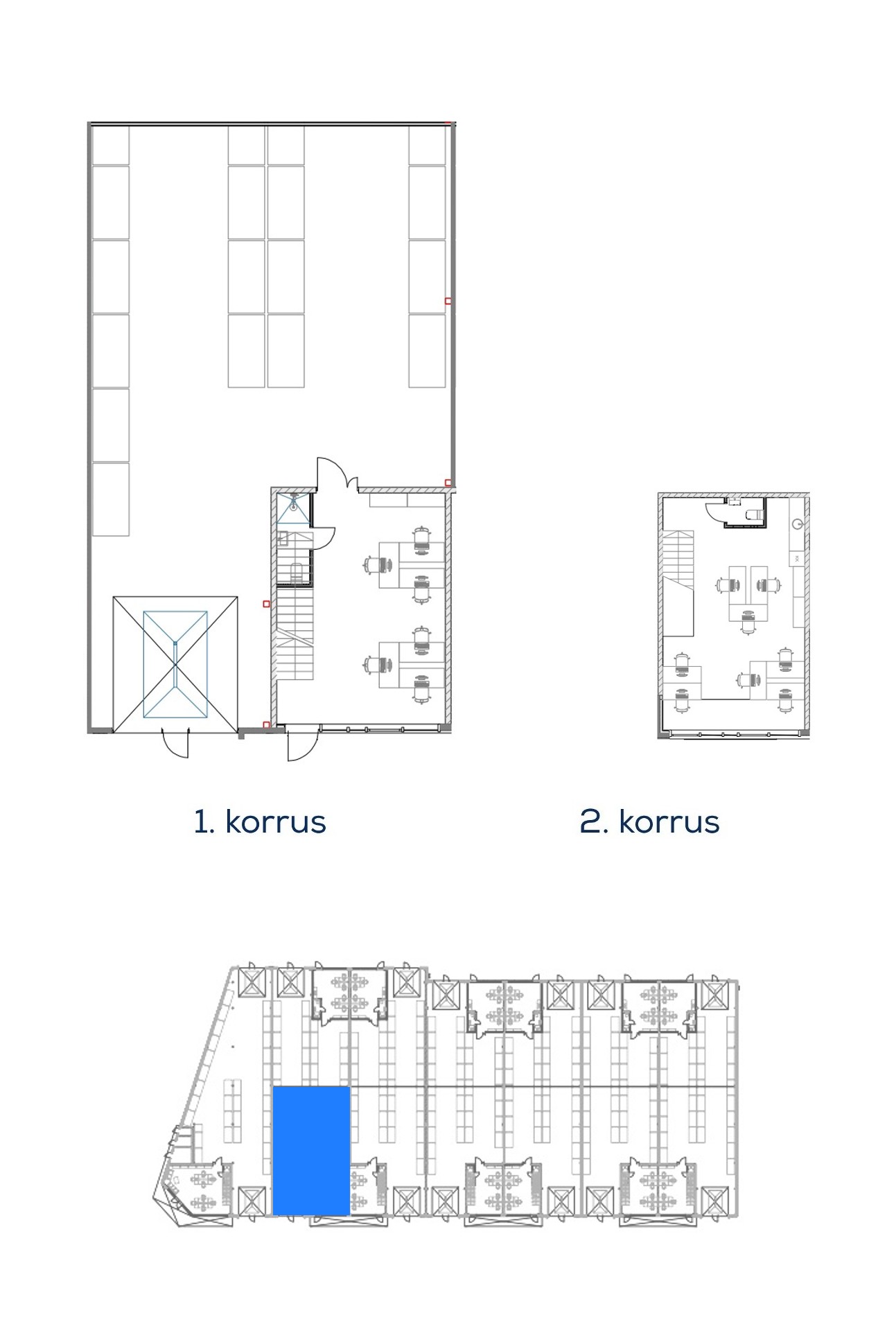

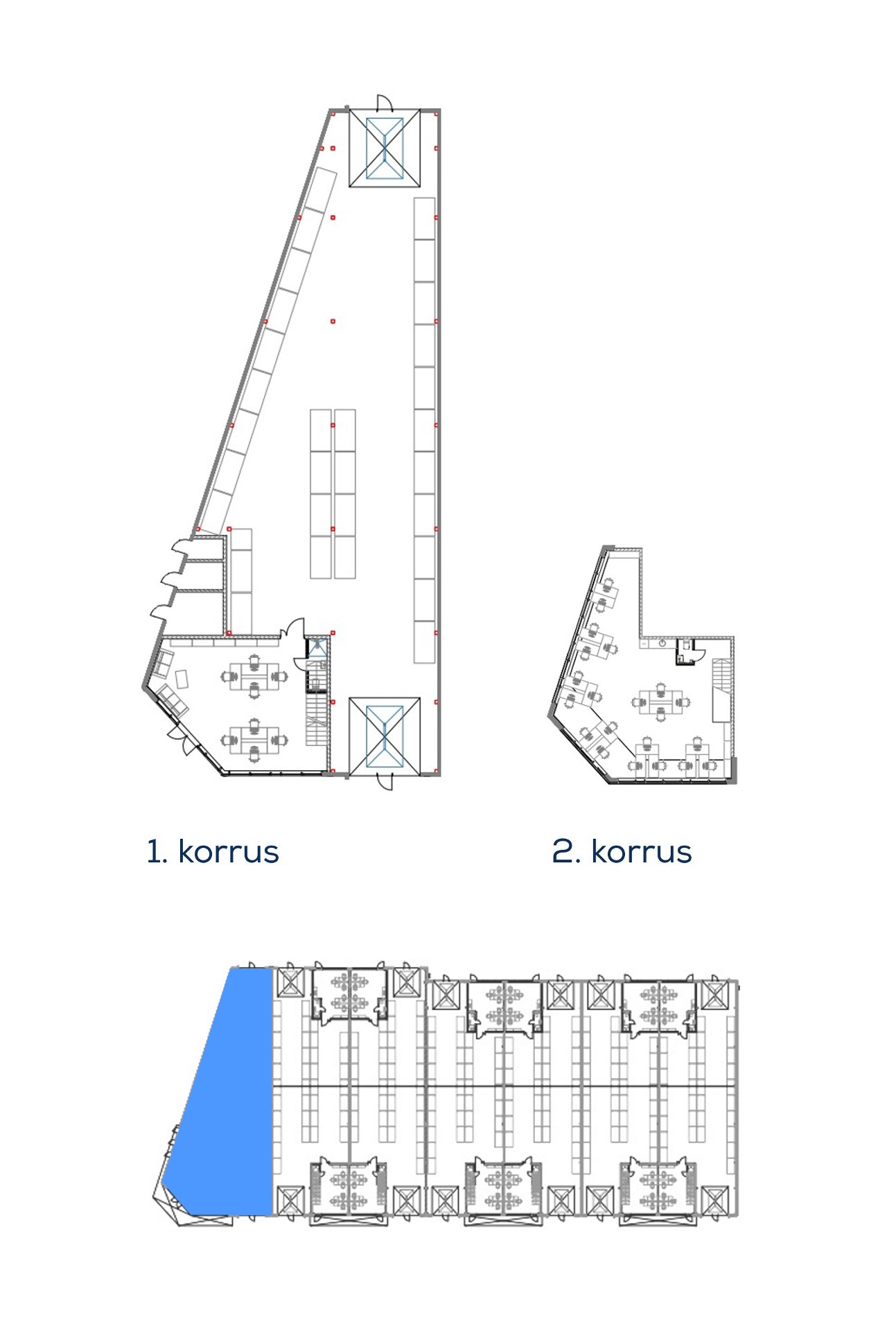

Requests for 200-300 m2 of warehouse space have become more frequent, so this market segment should also be considered when planning new projects. For businesses with higher space requirements, provision can be made for the most cost effective interconnection of booths and for increasing technical capacity. An important component of a successful project is the involvement of a general contractor who is able to adapt quickly to the specific needs of the companies that will later join the project.

2. Which warehouse spaces are currently selling the fastest and what will the demand trend be this year?

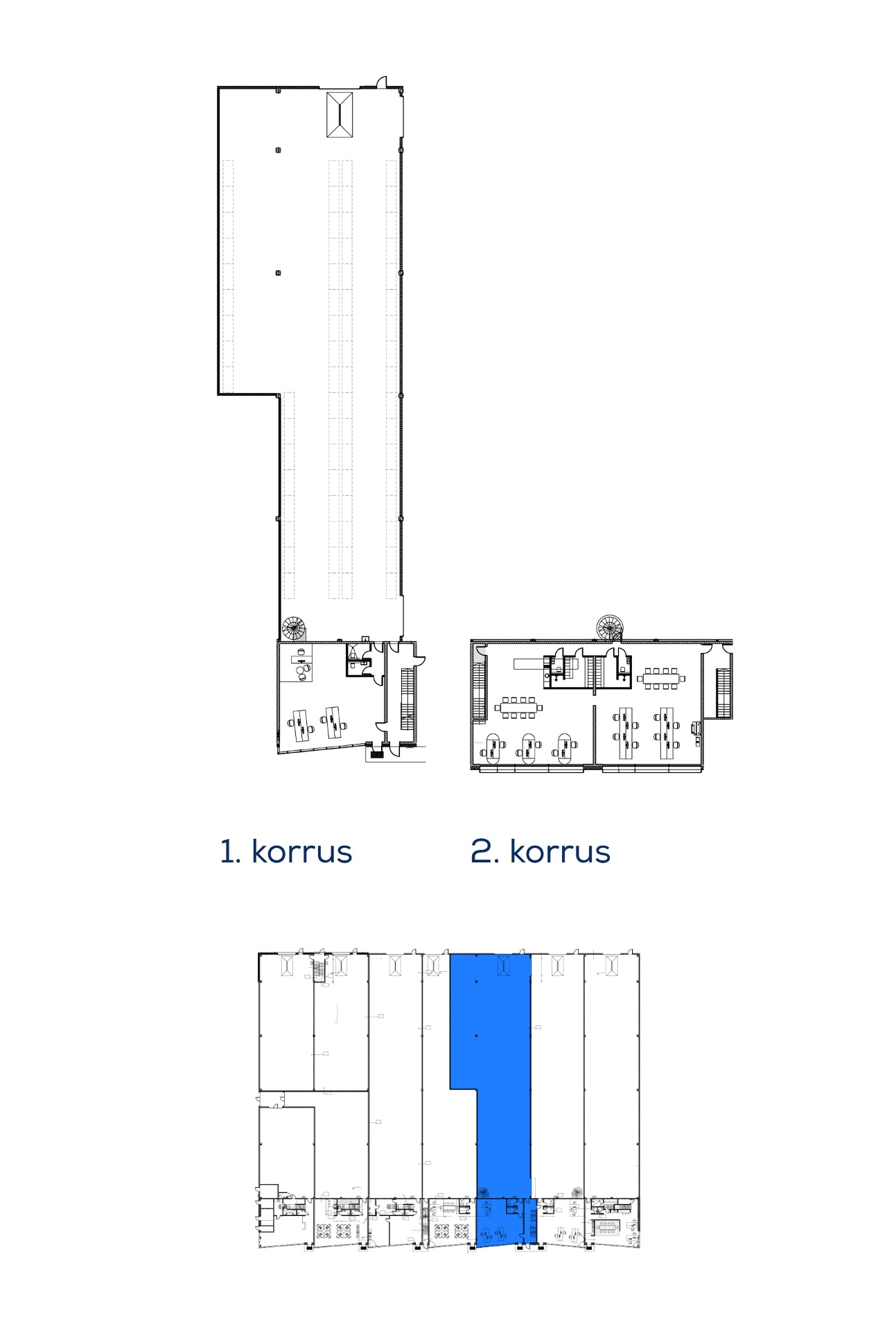

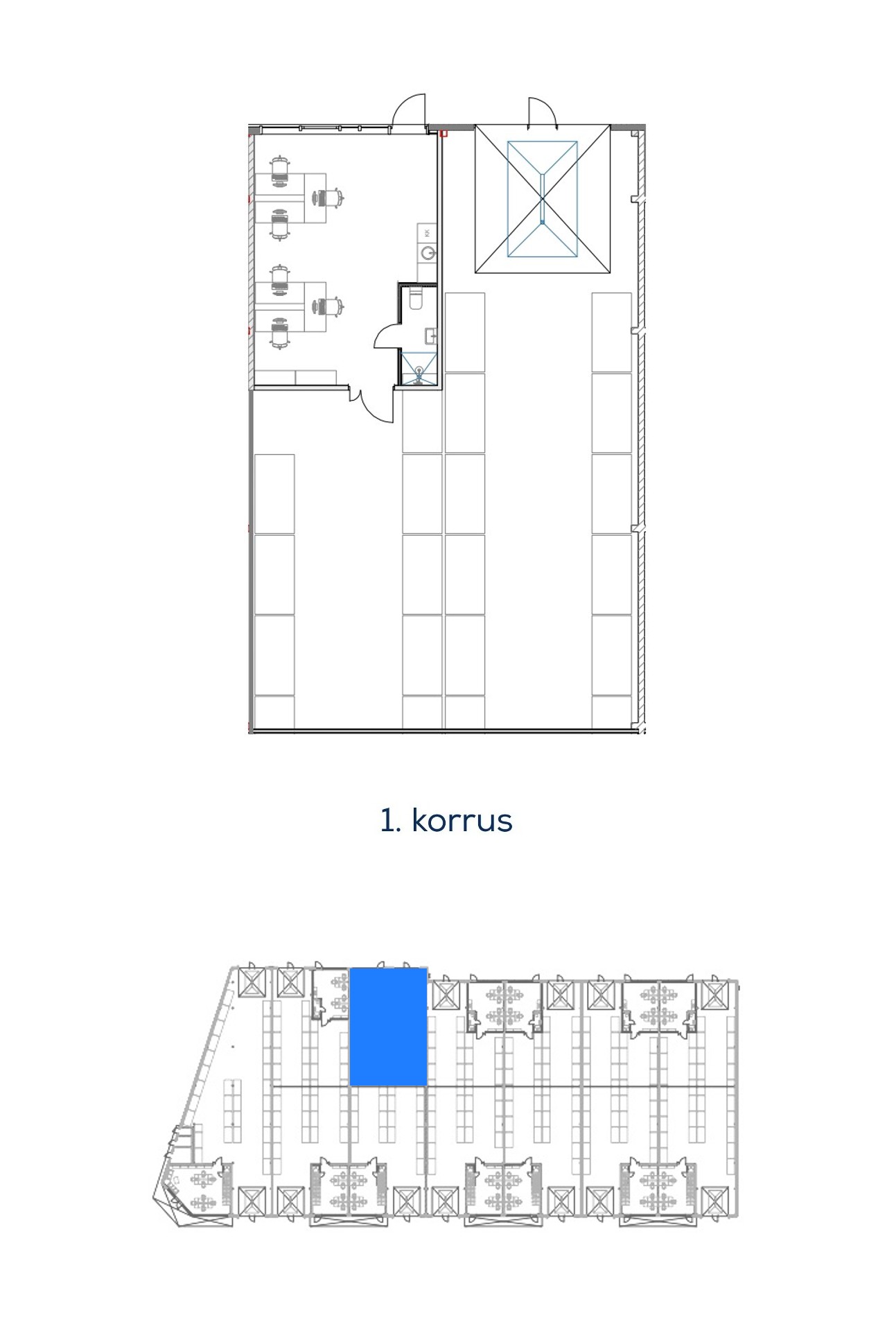

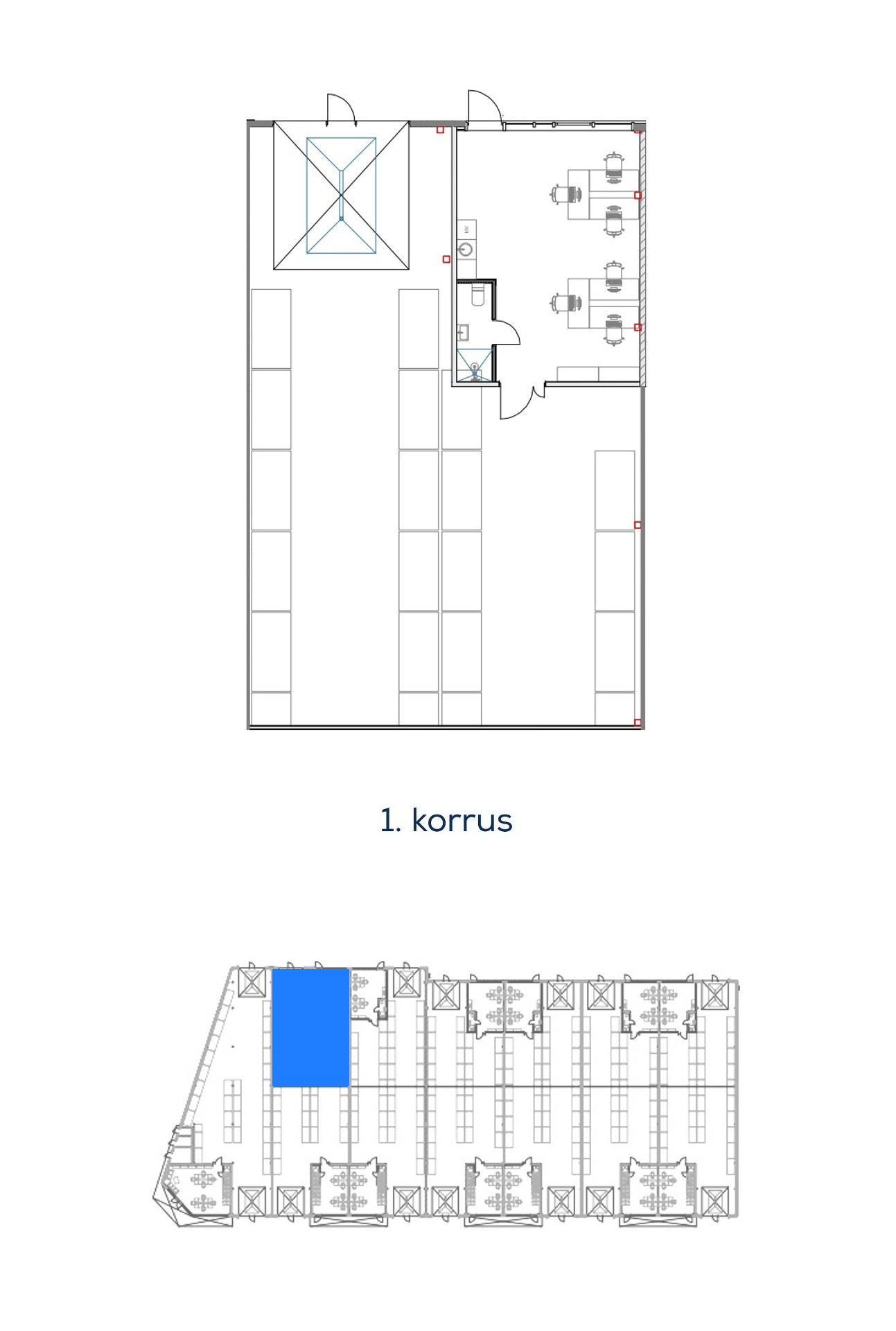

The fastest sellers are modern stock office type premises within the city. OAmong our projects under construction, the occupancy rate of the stock-office commercial space in Kadaka Trade Center is 100%, and more than 40% of the commercial space in the buildings to be completed in Väo Business Park by the end of 2024/beginning of 2025. Tähetorni Technology Park already has 30 companies in operation today, and thanks to this, we have already started construction of our fifth Favorte Stock office building.

Nowadays, there is no escaping the fact that low utility bills will probably remain an important factor for tenants for a long time to come. The average incremental cost of Favorte’s rental portfolio of new developments in 2023 was 1.7 eur/m2, a very good result given the high energy demand of manufacturing companies. If we compare new commercial premises with old, dilapidated ones, the savings on ancillary costs can be as much as two to three times higher. Resources that were previously spent on ancillary costs can be reinvested in the growth of the company.

An interesting and perhaps somewhat unexpected aspect is the chaotic pricing of electricity connections, which is surprising given that society as a whole is looking to move towards sustainability. A property developer will have to think hard about whether installing a solar park on the roof of a building will ever pay off. Therefore, companies concerned about a commercial building being green and producing “green energy” should be aware that such buildings are becoming increasingly scarce in the current market environment. In addition, tenants in our buildings can consume energy produced on the roof without paying a grid service charge. In just a few years, the Favorte solar park has produced 1,500 MWh of green energy, enough to fully charge more than 38,000 electric vehicles.

3. Which warehouse premises are worth investing in and which are not?

The first thing to consider when choosing a warehouse is its location from a logistical point of view. Is it close to major transport hubs and is it easy to get to? We see that today and in the coming years there will continue to be a demand for large warehouse buildings in the immediate vicinity of the Tallinn Ring Road. There is also a great demand in the direction of Paldiski Highway, where our fund (Favorte REIF Trustfund) has stock office type buildings and where the occupancy rate is 100 per cent as for today.

When investing, it is also worth paying attention to the type of warehouse building. Whether it will be an ordinary warehouse or a multi-functional space, where tenants can combine all their activities (warehouse, production, showroom and office) under one roof.

Property extras / benefits for tenants

Whether the property to be invested in has the solutions that are valued today (solar panels, charging points for electric cars, well-functioning management, attractive appearance, necessary electricity and communication connections, good accessibility and a sufficient number of parking spaces).

4. What is the current relationship between developers and large investors?

If we consider large investors to be companies that want to build and then buy an almost finished commercial building according to an individual project in cooperation with a developer, then starting from the end of 2023 there is a surge of requests for such stock office types of premises, with a total area of about 5000 m2.

We are currently in negotiations with several of these interested parties and are working to develop a solution that will support the growth of the client’s business. As the saying goes, the best time to buy a property was always five years ago and the next best time is today.

In the first three quarters of 2023, the number of parties interested in such a volume was very small, but today energy prices have stabilised and business expansion plans have been given the green light again.